Course Languague

HINDI

Speaker

CA POOJA GUPTA is a member of Institute of Chartered Accountants of India since 2009, Qualified ISA and M.Com. Also, She is ICAI faculty and Famous YouTuber with Channel name “CAGURUJI” having more than 480000 subscribers.

She delivers educational videos on Income TAX, GST and EXCEL. She has more than 10 year exeprience in Indirect taxation, Direct taxation and specialize in all aspect of GST, Income Tax, VAT, Service Tax, Excise etc.

Who should enroll in GST Certification Course :

GST Certification Course is for every Chartered Accountants (CAs), Tax Consultants, Tax Professionals, Accountants, Businessmen, All students and everyone who wishes to learn and study GST and become an expert in GST or wants to become a certified GST practictioner with GST Certification Course.

Duration of Webinar :

3 HOURS

Content of Course :

- MEANING OF GSTR-9 AND GST-9C

- WHEN IS TO BE FILED – (GSTR-9, GSTR-9C)

- IMPORTANT POINTS FOR GSTR-9 AND GSTR-9C

- CHECKLIST FOR GSTR-9C

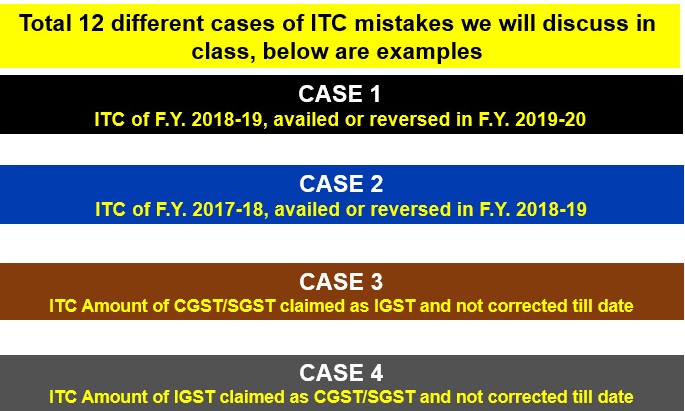

- MORE THAN 20+ EXAMPLES (TO PROVIDE SOLUTION FOR ALL MISTAKES RELATED TO INPUT AND OUTPUT)

- HOW TO SHOW DATA IN GSTR-9 RELATED TO F.Y. 2017-18 CLAIMED IN 2018-19

- HOW TO SHOW DATA IN GSTR-9 RELATED TO F.Y. 2018-19 CLAIMED IN 2019-20

- HOW TO SHOW DATA IN GSTR-9 RELATED TO F.Y. 2018-19 NOT CLAIMED TILL DATE

- HOW TO CORRECT ITC CLAIMED IN WRONG HEAD

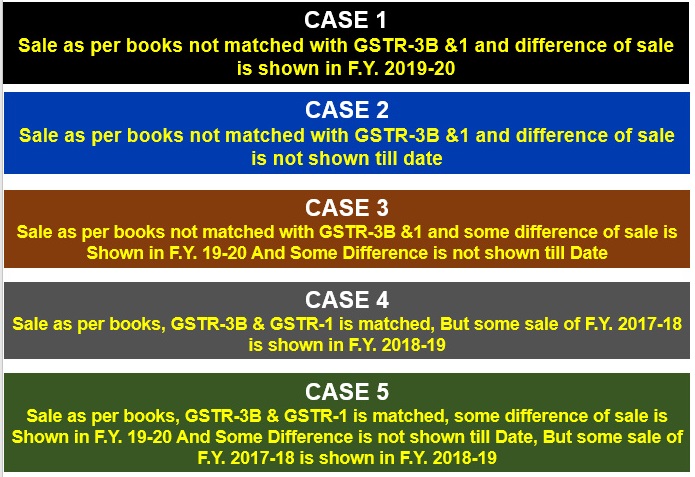

- HOW TO CORRECT OUTPUT TAX PAID IN WRONG HEAD

- GSTR-9 AND GSTR-9C DUE DATE FOR F.Y. 18-19 AND 19-20

- DETAIL ANAYLSIS OF FORM GSTR-9 AND FORM GSTR-9C

- LIVE TRAINING ON GSTR-9

- LIVE TRAINING ON GSTR-9C

Course Material

- PPT

- 25 Nos. + Excel files related to All cases of ITC and Outward Supply

- All Related Important Notifications

CASES RELATED TO OUTWARD SUPPLY

Reviews

There are no reviews yet.